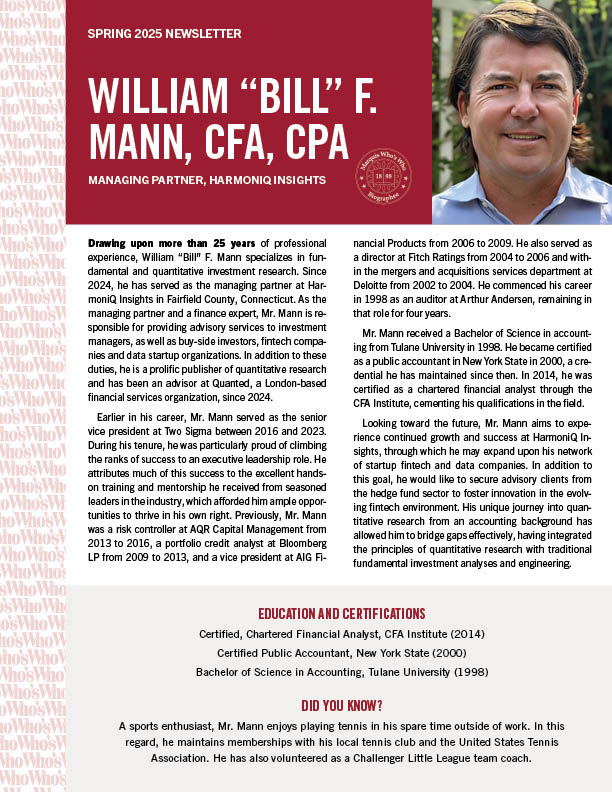

Drawing upon more than 25 years of professional experience, William “Bill” F. Mann specializes in fundamental and quantitative investment research. Since 2024, he has served as the managing partner at HarmoniQ Insights in Fairfield County, Connecticut. As the managing partner and a finance expert, Mr. Mann is responsible for providing advisory services to investment managers, as well as buy-side investors, fintech companies and data startup organizations. In addition to these duties, he is a prolific publisher of quantitative research and has been an advisor at Quanted, a London-based financial services organization, since 2024.

Earlier in his career, Mr. Mann served as the senior vice president at Two Sigma between 2016 and 2023. During his tenure, he was particularly proud of climbing the ranks of success to an executive leadership role. He attributes much of this success to the excellent hands-on training and mentorship he received from seasoned leaders in the industry, which afforded him ample opportunities to thrive in his own right. Previously, Mr. Mann was a risk controller at AQR Capital Management from 2013 to 2016, a portfolio credit analyst at Bloomberg LP from 2009 to 2013, and a vice president at AIG Financial Products from 2006 to 2009. He also served as a director at Fitch Ratings from 2004 to 2006 and within the mergers and acquisitions services department at Deloitte from 2002 to 2004. He commenced his career in 1998 as an auditor at Arthur Andersen, remaining in that role for four years.

Mr. Mann received a Bachelor of Science in accounting from Tulane University in 1998. He became certified as a public accountant in New York State in 2000, a credential he has maintained since then. In 2014, he was certified as a chartered financial analyst through the CFA Institute, cementing his qualifications in the field.

Looking toward the future, Mr. Mann aims to experience continued growth and success at HarmoniQ Insights, through which he may expand upon his network of startup fintech and data companies. In addition to this goal, he would like to secure advisory clients from the hedge fund sector to foster innovation in the evolving fintech environment. His unique journey into quantitative research from an accounting background has allowed him to bridge gaps effectively, having integrated the principles of quantitative research with traditional fundamental investment analyses and engineering.